7 Simple Techniques For Best Broker For Forex Trading

7 Simple Techniques For Best Broker For Forex Trading

Blog Article

Getting My Best Broker For Forex Trading To Work

Table of Contents6 Simple Techniques For Best Broker For Forex TradingSome Known Facts About Best Broker For Forex Trading.Some Known Questions About Best Broker For Forex Trading.8 Easy Facts About Best Broker For Forex Trading ExplainedThe Facts About Best Broker For Forex Trading Revealed

Because Forex markets have such a huge spread and are utilized by a huge variety of participants, they provide high liquidity on the other hand with other markets. The Foreign exchange trading market is frequently operating, and thanks to contemporary innovation, comes from anywhere. Hence, liquidity refers to the reality that anybody can acquire or offer with a simple click of a button.Because of this, there is always a potential retailer waiting to acquire or offer making Forex a liquid market. Rate volatility is among the most essential aspects that aid select the next trading step. For short-term Forex investors, price volatility is crucial, since it portrays the per hour adjustments in a possession's worth.

For long-term capitalists when they trade Foreign exchange, the cost volatility of the marketplace is also basic. This is why they consider a "purchase and hold" technique might use greater earnings after a lengthy duration. Another substantial advantage of Foreign exchange is hedging that can be applied to your trading account. This is an efficient technique that aids either get rid of or minimize their threat of losses.

Not known Factual Statements About Best Broker For Forex Trading

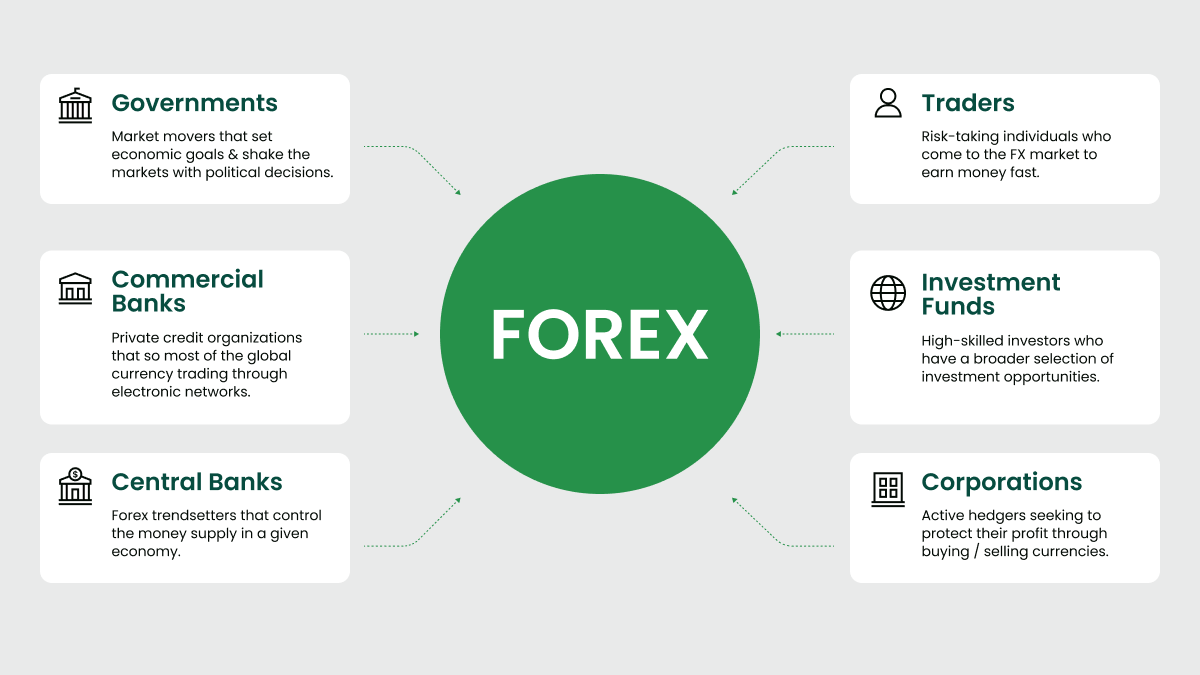

Depending on the moment and effort, traders can be divided into groups according to their trading design. Several of them are the following: Foreign exchange trading can be efficiently used in any of the methods over. Due to the Foreign exchange market's terrific volume and its high liquidity, it's possible to enter or exit the market any type of time.

Forex trading is a decentralized modern technology that works with no central administration. An international Forex broker need to comply with the standards that are defined by the Foreign exchange regulator.

Therefore, all the transactions can be made from anywhere, and considering that it is open 24 hr a day, it can likewise be done at any moment of the day. If a financier is located in Europe, he can trade throughout North America hours and keep an eye on the actions of the one money websites he is interested in.

The Definitive Guide to Best Broker For Forex Trading

In comparison with the stocks, Forex has really reduced purchase prices. This is due to the fact that brokers make their returns through "Things in Percent" (pip). Many Forex brokers can use a really low spread and reduce or also get rid of the investor's prices. Capitalists that select the Forex market can boost their income by avoiding charges from exchanges, deposits, and other trading tasks which have extra retail deal costs in the stock market.

It offers the option to enter the market with a little budget and profession with high-value money. Some traders may not fulfill the demands of high utilize at the end of the deal.

Foreign exchange trading may have trading terms to protect the market participants, yet there is the danger that someone may not appreciate the agreed contract. The Foreign exchange market works 24 hours without stopping.

When retail investors refer to cost volatility in Foreign exchange, they suggest how huge the upswings and downswings of a currency pair are for a particular duration. The larger those ups and downs are, the higher the rate volatility - Best Broker For Forex Trading. Those large adjustments can stimulate a feeling of unpredictability, and sometimes traders consider them as a possibility for high profits.

Unknown Facts About Best Broker For Forex Trading

Several of the most unstable money pairs are considered to be the following: The Forex market uses a great deal of opportunities to any kind of Foreign exchange trader. Once having decided to trade on forex, both knowledgeable and newbies need to specify their monetary strategy and get acquainted with the conditions.

The content of this article reflects the writer's point of view and does not necessarily show the official setting of LiteFinance broker. The product published on this page is offered informational functions just and should not be thought about as the provision of investment recommendations for the objectives of Directive 2014/65/EU. According to copyright law, this site link post is taken into consideration intellectual home, that includes a restriction on copying and dispersing it without authorization.

If your firm works internationally, it is essential to understand how the worth of the U.S. dollar, relative to other currencies, can substantially influence the price of goods for U.S. importers and merchants.

Not known Details About Best Broker For Forex Trading

In the early 19th century, currency exchange was a major component of the procedures of Alex. Brown & Sons, the very first investment bank in the USA. The Bretton Woods Arrangement in 1944 needed currencies to be pegged to the US dollar, which was in turn pegged to the cost of gold.

Report this page